Transformation of a Vision into Reality

Esquare Biztech led a finance startup to turn its treasury business vision into a reality.

Esquare Biztech Solutions handheld, a finance startup by implementing technology right from conceptualization to culmination. We transformed their ideas into an agile and sustainable solution.

Microsoft Azure – WebApps

Microsoft Azure – WebApps SQL Azure

SQL Azure Apache NiFi

Apache NiFi SWIFT

SWIFT WinAutomation

WinAutomation Microsoft .Net

Microsoft .Net MVC

MVC HTML5

HTML5 JavaScript

JavaScript Angular

Angular Lamda

Lamda AWS

AWS Node.js

Node.js

Our Client

A group of individuals envisioned having a treasury business to help charitable organizations manage their finances in the best way. They had ideas to manage day-to-day business obligations while also helping develop their long-term financial strategy and policies.

Client’s Requirements

01

Decreased Manual Efforts

Technology is needed to manage the money and financial risks. And we all know that managing accounts in cloud-based technology are way better than excel sheets, so our clients needed that.

02

Reduction of Transactional Charges

International transactions can attract heavy transactional charges. Thus, when it comes to organizations doing this daily, they need to keep in check with the economic factors such as interest rate rises, changes in regulations, and volatile foreign exchange rates.

03

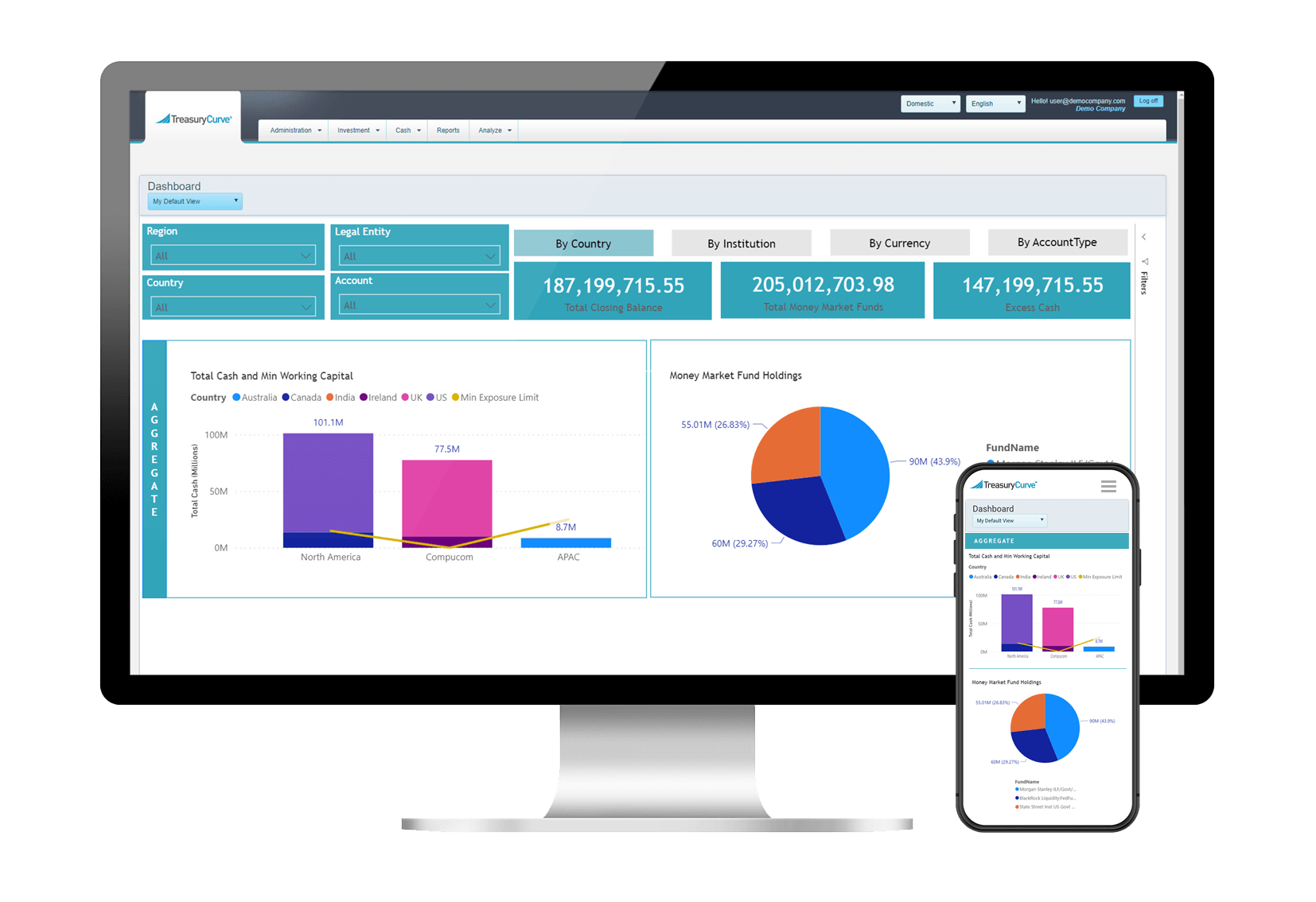

Optimized Dashboard

When technology is implemented, it should be agile and have a meaningful dashboard. The dashboard should be optimized to quickly give the insights to treasury team to make quick decisions.

04

Integrated system for all accounts and third-party tools

Who will want the hassle of having a different system for every transaction? Thus integration is a must. The solution must be agile enough to integrate third-party tools while ensuring top-notch security.

05

Seamless investment process

The technology built should be able to calculate the investments and their maturity dates and keep in the loop with every information. It must provide the entire team of treasury professionals, each with their area of responsibility and expertise, with the best knowledge.

06

Predictive Analysis

A treasury business requires an incredible predictive analysis for operational efficiency and process optimization. This analysis helps the organizations to invest securely and make informed decisions.

After going through all the requirements details, Esquare Biztech chose the best team to conceptualize, develop, implement and deploy the desired solutions.

Our Platter of Solutions

01

Agile, Integrated, and Robust Solution

Esquare Biztech critically examined the clients’ requirements and provided them with an agile, robust, integrated solution.

02

Scalable Solution with HADR

We understand that treasury is a business that requires a scalable solution. It must be designed to scale up and down according to the clients’ need and also must have high availability along with disaster recovery architected properly.

03

Robust and integrated tools

Our expert team conceptualized and integrated a cash and investment management tool and other tools to make the system robust. The process was automated, from managing receipts and disbursements according to common standards and practices to developing and generating cash management reports.

04

Predictive Analysis

Our team designed the predictive analysis algorithm to identify investment opportunities based on the caseflow.

05

Cost Saving & Compliance Solutions

The new system would save many resources and make the treasury business a simplified process for multiple accounts. The automated procedure ensured that the audits related to technology, regulations, and new financial products were in place and compliances were met.